Lessons

So...Merrill (MER) sells to Bank of America (BAC), most likely to avoid bankruptcy, Lehman (LEH) files for bankruptcy, Bear Stearns (BSC) sells to JP Morgan (JPM), again most likely to avoid bankruptcy. Major financial institutions — once revered as the "crown jewels" of the financial community — are failing. And all I can think is...

Are you kidding me?!?

Aren't these supposed to be the greatest financial minds and businesses in the world?

Investing vs. The Business of Investing

The media seems to be soft-shoeing around one issue: These companies are supposed to be in the business of managing money. They preach diversification, conservative values, and "intelligent" investing, and then...

- they leverage their firms to buy crap investments and

- assume tons of risk,

- with absolute disregard for their bosses — the shareholders

- who have collectively lost hundreds of billions of dollars

- while the executives have collectively taken home billions of dollars.

They've done it time and time again (think dot-com). And these are the people overseeing the financial futures of millions of investors around the world.

There is a massive disconnect between investing and the business of investing. The "brilliant" minds of Wall Street have once again proven that they are good at the business of investing...but they don't know jack about investing. And once again, Joe and Jane Investor — good people that want to retire comfortably, but realize that they want to focus on anything but investing — get suckered into trusting their money to firms that sell "investing"...but focus on the business of investing.

What is "The Business of Investing"? Making The Case with Mutual Funds.

Many of these large brokerage houses (even if they call themselves Investment Banks) are not in the business of providing growth- and safety-oriented investment advice and portfolio management. They are in the business of selling investments. Any advice they provide is incidental to that end.

How do they make more money? Sell more investments...to more people. The problem — one we've discussed a million times here — is that, at any given time, there are only a handful of truly wonderful investment opportunities available (if any). If these companies waited to sell just those great investments, they'd go broke.

There's very little money to be made recommending our strategy [buy-and-hold].Your broker would starve to death. Recommending something to be held for 30 years is a level of self-sacrifice you'll rarely see in a monastery, let alone a brokerage house. — Warren Buffett

(And, of course, that's why F Wall Street's headline reads: If Wall Street told you how to invest properly, they'd be out of business.)

How do they sell investments? On the one hand, they are investment banks — raising money for companies through IPOs, secondary offerings, bond issuances, and more. On the other hand, they strong-arm mutual funds to churn garbage in Joe and Jane Investor's portfolios.

The Basics of Mutual Funds

To best understand this, you must first understand the business of mutual funds. A mutual fund is a pool of investor money used to buy, hold, and sell stocks, bonds, or other securities. When you buy shares of a mutual fund, the mutual fund manager gets the cash and invests it according to "the Plan" outlined in the prospectus.

(For readers with a more in-depth understanding of mutual funds, I am talking about open-ended funds — the type that Wall Street will typically sell to Joe and Jane Investor, through their IRAs, 401(k) plans, and other accounts.)

Mutual funds are run by mutual fund companies — businesses that make money based on how much of Joe and Jane's money are in the mutual funds, regardless of how intelligently that money is invested or how it performs. All things being equal, a mutual fund company with $1 billion in assets will make ten times more money than a mutual fund company with $100 million in assets.

Get more assets...make more money.

The Whys and Hows of Mutual Fund Strong-Arming

The major Wall Street firms control the assets. Mutual fund companies (read: the executives) make money based on how much money they manage. What do you think a mutual fund company would do to get in bed with Wall Street? Quarterly kickbacks? Pay some of the Wall Street firm's expenses? Perhaps buy some garbage investments from the Wall Street firms that have to sell mediocre and bad investments to make more money?

Try "all of the above" and then some. (You didn't know you could find this information? Sure! It's comfortably buried on page 212 of the Statement of Information filed with the SEC. They didn't tell you about that? Hmmmm.) It's a match made in heaven — mutual fund companies earn higher fees on more assets under management, Wall Street gets a vehicle that will (i) engage in a high number of transactions that will generate commissions, and (ii) buy shoddy investments and hide them among their hundreds or thousands of other positions.

It's a dirty business, and everybody wins but the mutual fund investor.

Are All Mutual Funds Bad?

No. According to the 2008 Investment Company Fact Book issued by the Investment Company Institute, there were 8,752 mutual funds operating in 2007, some of which don't engage in Wall Street's tomfoolery. Of course, you'll likely never hear of them because they focus on growing and preserving wealth — not on getting their name in the news or climbing into bed with Wall Street.

Today's Credit Crisis

So focused on the business of selling investments, these grand old investment firms forgot some of the most basic rules of investing; so, let's review them here:

- never invest in something you don't understand. (If you lose everything and go bankrupt — or sell your firm to stave off bankruptcy — you clearly did not understand what you were investing in.)

- avoid permanent loss. (Recognize that some investments will go bad and manage your portfolio to prevent a total loss of the entire portfolio, even if some investments result in losses.)

- figure out the strength of the floor before you salivate at the look of the ceiling. (Know what is at risk before you drool over potential profits. The Sistine Chapel is beautiful; but, having to jump over a 40-foot-wide black hole to sneak a peek may not make it worth viewing.)

- focus on intrinsic value. (The value of every opportunity lies entirely in the future, regardless of the past. Just because big bets on bad debt worked in the past does not mean they will continue to work in the future. You have to figure out the value of those bets — not just the price and profit potential.)

- the company you run belongs to your shareholders. (Don't focus on how big or "savvy" you are. Focus on what is in the best interests of your shareholders. In case you missed the memo: Putting your business at risk of bankruptcy is not in the best interests of your shareholders.)

The list goes on and on.

Attention Joe and Jane Investor — Here's What To Do.

First off, go ahead and make a run on your banks. If you have money with a brokerage firm or bank that is in trouble, get your money the heck out of there! Over the weekend, I spoke to a number of friends and family with savings and checking accounts at Midwest Bank (MBHI) — a well-known local bank — that appears to have lost roughly 1/3 of its equity after its bets on Fannie Mae and Freddie Mac went south.

Should you risk your savings because your banker took too much risk?

In reality, I don't want to cause a run on the banks; but, I won't prevent one by saying that everything is fine and that you should wait until it is too late. My recommendation: Move your important savings and checking accounts to banks that have a higher likelihood of weathering the storm. US Bank gets my vote of confidence for checking and savings accounts.

If you have more than $100,000 at the bank... Open a brokerage account and get unlimited insurance on your account. Companies like TD Ameritrade (AMTD) will take out 3rd-party insurance on your account so that, if they fail, your assets are safe. (Compare that to having $500,000 at a bank that fails, leaving you with just $100,000 of FDIC reimbursement.)

You can easily transfer money back and forth electronically between US Bank and TD Ameritrade; so, you don't have to worry about locking up your funds. (Yes — brokerage accounts can act just like savings accounts, and you can even buy CDs.)

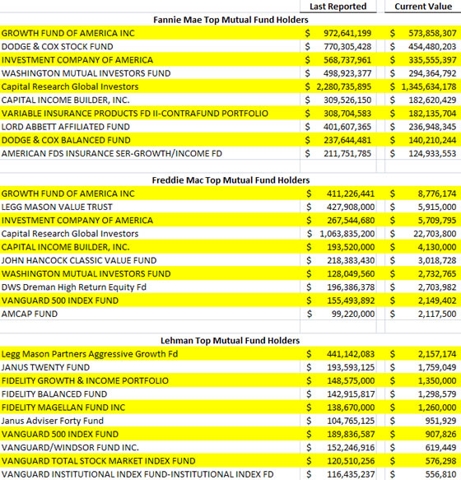

Sell your garbage mutual funds. You are better off in cash than in bad investments. I'd be quite angry at my mutual fund managers if they held Lehman, or had big bets on Fannie Mae (FNM) or Freddie Mac (FRE). Kind of like some of these guys:

$11.5 billion of Joe and Jane Investor's money...now worth just $3.9 billion assuming these giants still held these positions. (Funny how familiar some of the names are, too. I wonder if these guys were in bed with Wall Street? What else might drive them to hold $11.5 billion in these risky bets? 8,752 mutual funds out there, and the same names keep popping up. Hmmm.)

At the very least, this is a start to protecting what you have.

Remember: Cash Is King

If you've learned nothing else from this credit crisis, you should walk away with two lessons:

- Most investment firms are in the business of selling investments, not in the business of investing for growth and safety; and,

- Each firm is failing because they don't have enough cash to pay the bills and keep the doors open.

When it comes down to it, the value of a business is the value of the cash that the business can generate throughout its remaining life. When a business can't generate enough cash to keep operations going, it must sell to another firm, borrow money, issue shares, or close up shop. (That's why these financial giants keep looking for and raising billions in capital to offset losses.)

Focus first on preserving your savings. Then, take steps to grow it. Don't be a mutual fund pawn in Wall Street's game of ever-increasing sales. Instead, look for individual businesses than can generate excess cash, and have a high probability of doing so in the future.

As we're seeing today, no business can survive forever without the ability to generate excess cash. Then again, no business ever failed because it generated too much cash.

If the 300 point drops in the Dow make you sick to your stomach, perhaps it's time to change your strategy.

Source - Seeking Alpha

0 Comments:

Post a Comment

<< Home